Timing Of Advice

How are your financial professionals approaching this important dimension?

Context matters.

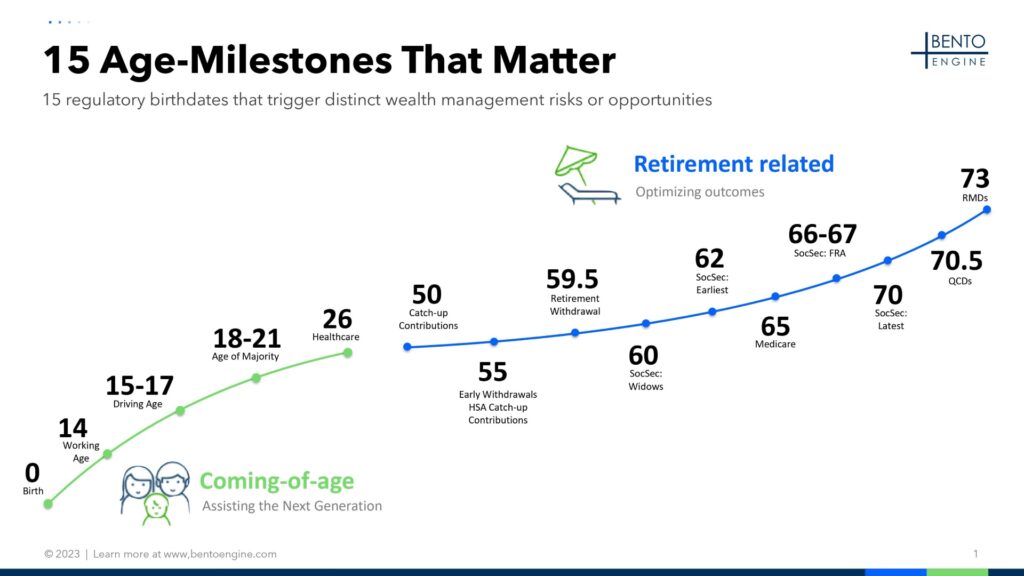

The best advice rendered at the wrong point in time tends to fall flat. Picking the right time to reach out to and advise the client or prospect is key to success. Whenever possible, impactful advice should be rendered proactively, ahead of clients reaching key decision points — after all, everyone appreciates and benefits from a timely “heads-up”. How proactive to be, how many months before clients reach for example the 15 ‘regulatory birthdates’ on their life journeys depends not only on the individual psychology of the client (some are more strategic, some more tactical), but also on the advice opportunity at hand.

When reflecting about the 15 age-based milestones that matter to clients and their families, it becomes obvious that not all are created equal. For some of them, a short lead-time of 1 to 3 months before the actual event will be perfectly sufficient – e.g., securing “Working Papers” when the kids turn 14 or getting the Healthcare and Financial POAs (Powers of Attorney) into place when the Next Gen of your client family reaches their Age of Majority will be perfectly sufficient. Other topics, however, think for example of Medicare at age 65 or determining the best timing to file for Social Security Benefits as clients approach age 62, warrant much longer lead-times, perhaps 18 to 24 months. This is to allow for sufficient time for thorough analysis and arranging for alternatives as needed.

With respect to Life Events, some are somewhat plannable and provide sufficient lead-time to both the advisor and their client in natural ways (e.g., getting married having a baby or buying a home), while others can be very sudden “curve balls” that need to be addressed as they occur (e.g., a sudden death in the family, or a windfall profit). In the latter instances, fast is not always better – for example, in case of tragic losses, advisors must show respect and ‘Fingerspitzengefuehl’ to show true empathy by connecting first and foremost on a human level, and only when the time is right addressing the financial implications.

How is your organization, how are your financial professionals approaching the important dimension of Timing of Advice? To learn more, see our Whitepaper “The Timing of Advice”:

Explore our CRM-Embedded Solutions:

Life in #s

Want to proactively advise your entire book of business on upcoming age milestones that trigger distinct wealth management risks or opportunities? You can do that.

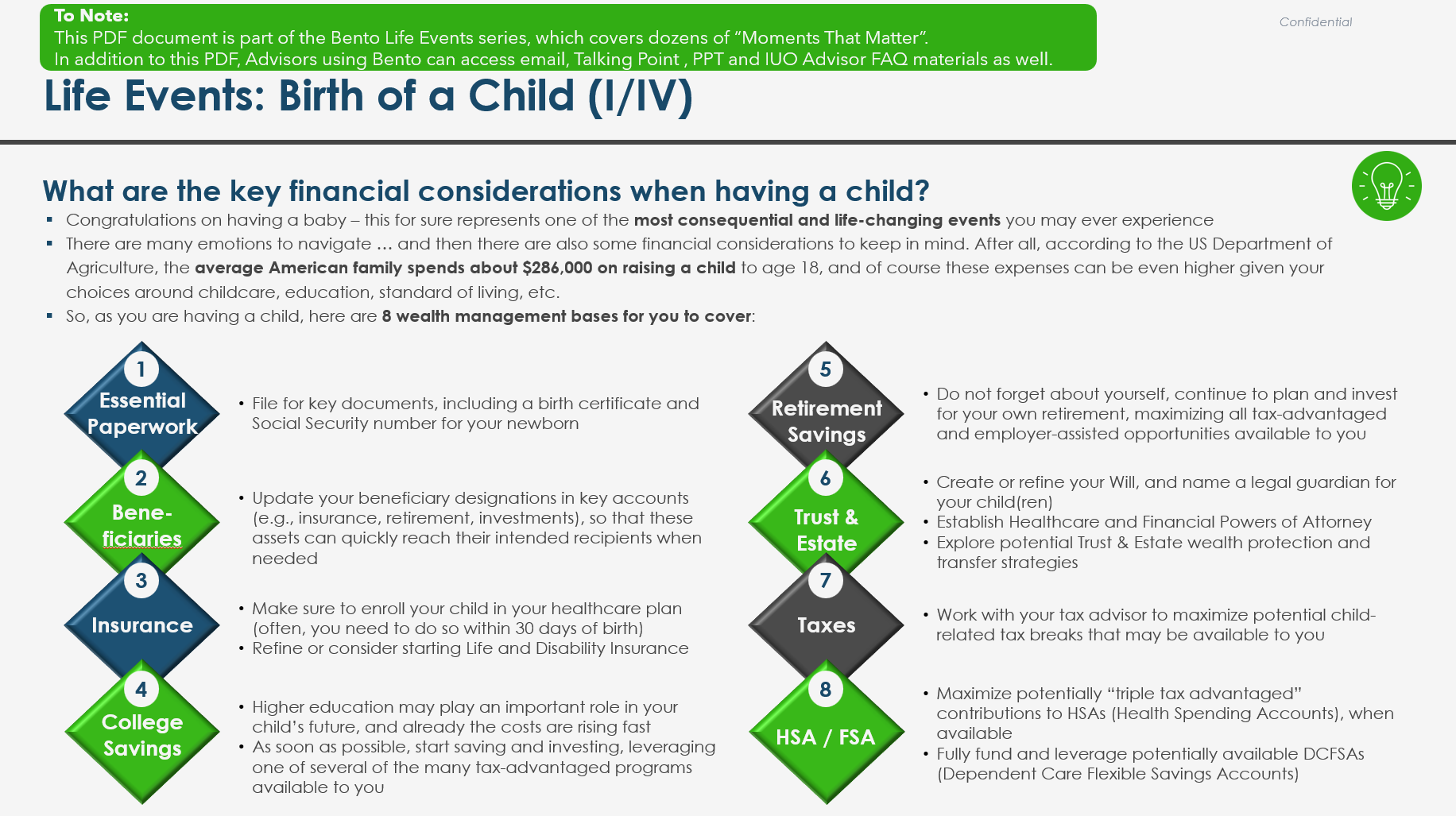

Life Events

Want to be there for your clients during major Life Events such as getting married, divorced or having a child? We've got you covered.

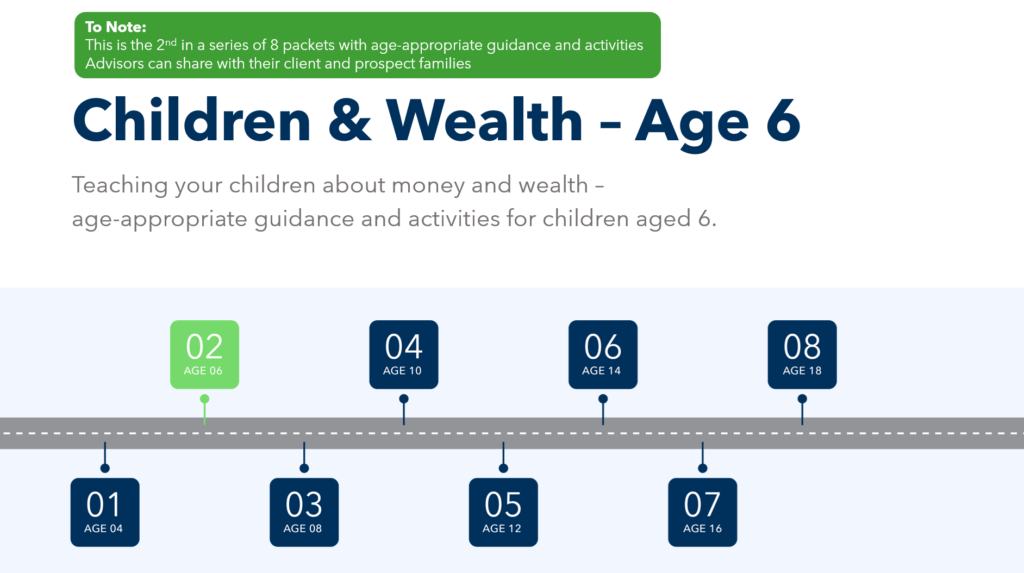

Children Wealth

Care about the Next Generation of your client family and want to help parents instill Financial Literacy? Bento can help.