Driving CRM Adoption

Are your financial professionals spending productive time in their CRM?

Are You Making The Most of Your CRM?

CRMs (Customer Relationship Management Systems) are increasingly becoming the hub of the tech stack of client-centric firms going forward. By now 96% of financial professionals report using a CRM (Source: T3). More and more firms are leveraging the power of the CRM beyond simple record keeping, they view the CRM as the “golden source of information” that their entire practice hinges on.

They understand the data value chain, which can be described as:

- Data leads to information

- Information leads to insight

- Insight leads to recommendations

- Recommendations lead to action

- And action, you guessed it, leads to new data

But how do you tee your firm and your professionals up for success?

What are some of the key challenges the industry is still grappling with? Many firms are still working on improving their CRM game, including:

Data completeness

Real quick: are you sure you know the ages of all your client's children and grandchildren? And for what percent of your hot prospects do you know the actual Date of Birth?

Data accuracy

Real quick: are you sure the primary addresses for all of your clients above the age of 60 are still correct? And for what percent of your client families do you have the full family appropriately householded?

Advisor adoption

Real quick: what percent of your senior advisors are in their CRM every working day? And what percentage of calls get appropriately logged in the CRM?

Many firms have tried to simply mandate the above, with limited success at best. Thoughtful CTOs, Sales Leaders and Practice Management Heads acknowledge that heavy-handed ‘top-down’ approaches to driving better CRM hygiene only get them so far — many professionals still find plenty of ways to circumvent CRM best practices.

Instead of ruling by the stick, we recommend leading with the carrot — giving professionals tangible reasons to fully embrace the CRM, providing them with real incentives for doing the right thing. Rather than asking them to input all the time, how about having the CRM provide valuable insights and materials to them, when they need it the most, to serve and engage clients and prospects. Making the CRM a two-way street is key to success.

How Bento Works

Via APIs, Bento is embedded in your CRM. No new login, no new app on the workstation, no new system to learn.

Explore our CRM-Embedded Solutions:

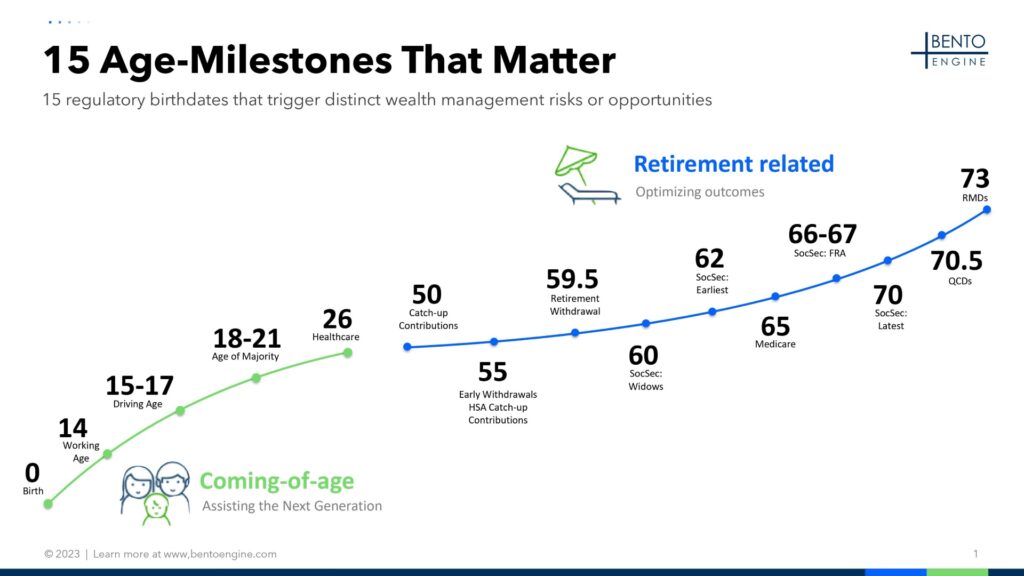

Life in #s

Want to proactively advise your entire book of business on upcoming age milestones that trigger distinct wealth management risks or opportunities? You can do that.

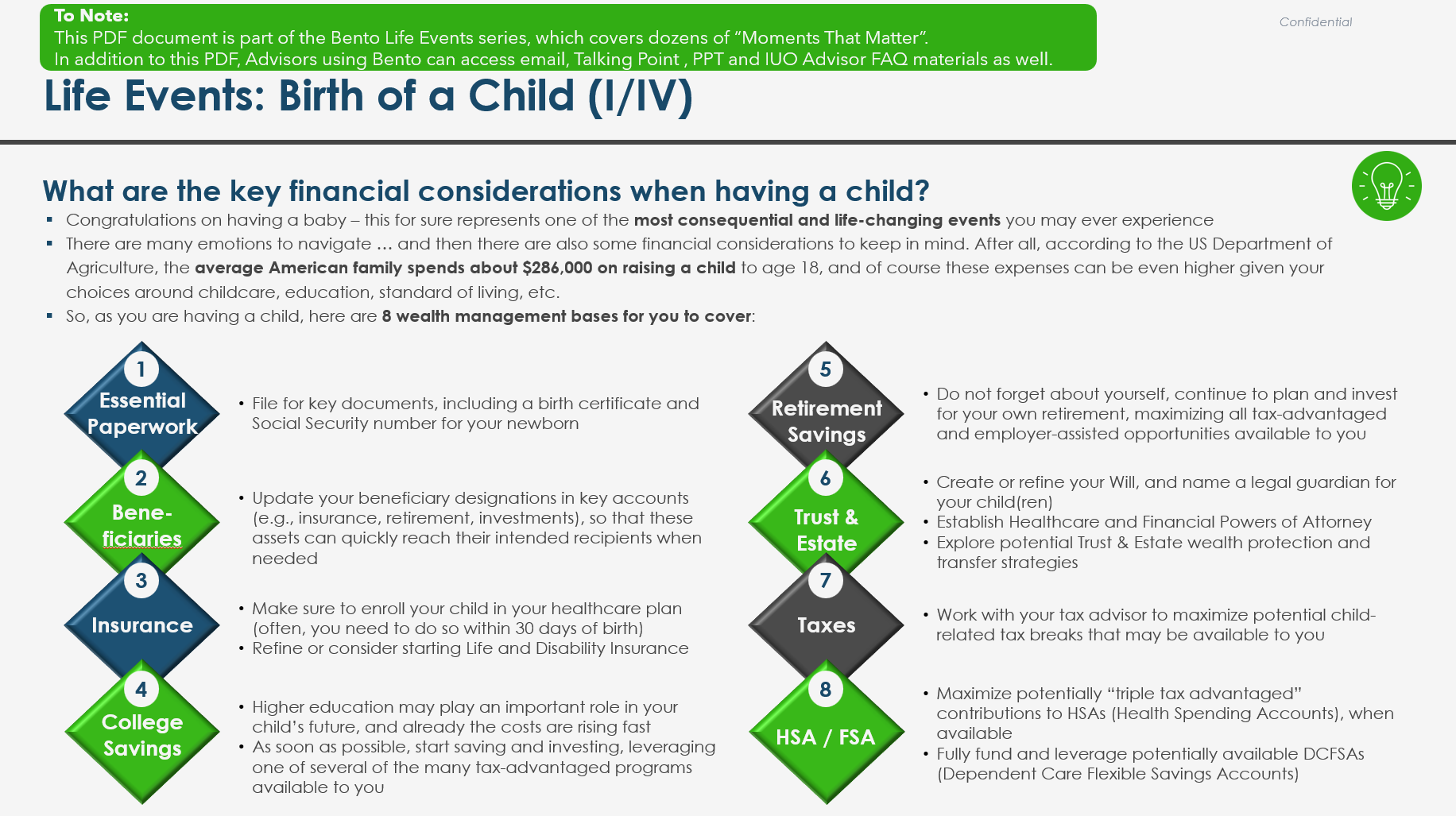

Life Events

Want to be there for your clients during major Life Events such as getting married, divorced or having a child? We've got you covered.

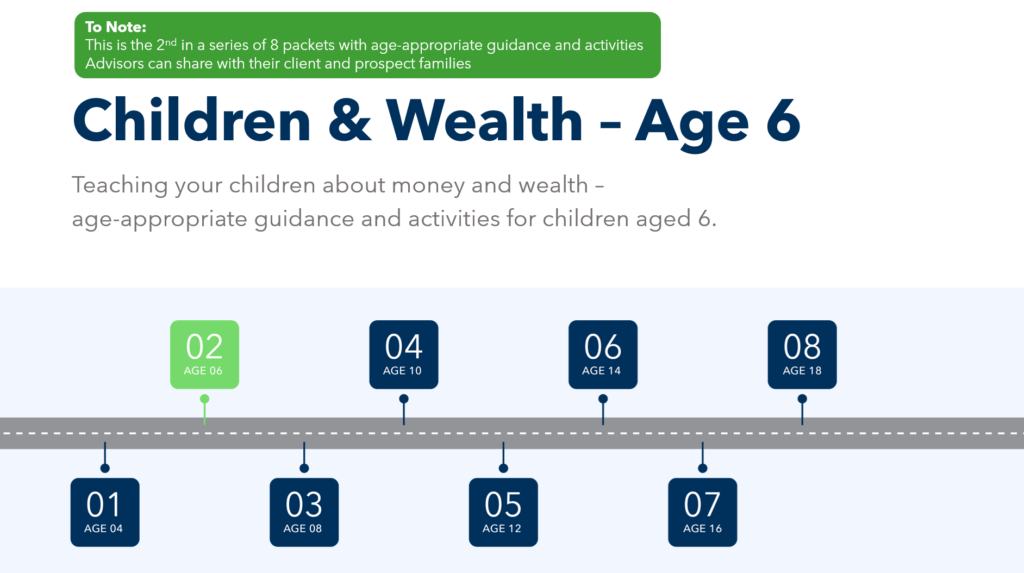

Children Wealth

Care about the Next Generation of your client family and want to help parents instill Financial Literacy? Bento can help.