Bento & FMG Partnership

FMG is a leading advisor marketing platform … that is now housing a new “Bento Collection”. FMG users can now access a sub-set of our materials right on the FMG platform, and that way even better engage and advise their clients (and prospects!) during “Moments That Matter”.

What is FMG?

What is Bento Engine?

What are "Moments That Matter"?

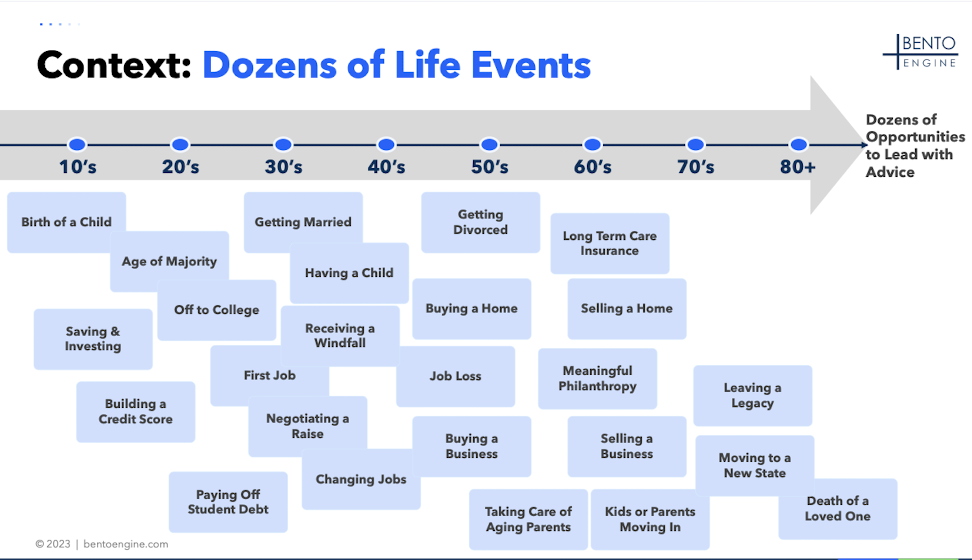

Life is full of “Moments That Matter”, which provide client-centric advisors dozens of opportunities to engage and serve their clients. So Bento packaged all those moments into 3 distinct advisory programs:

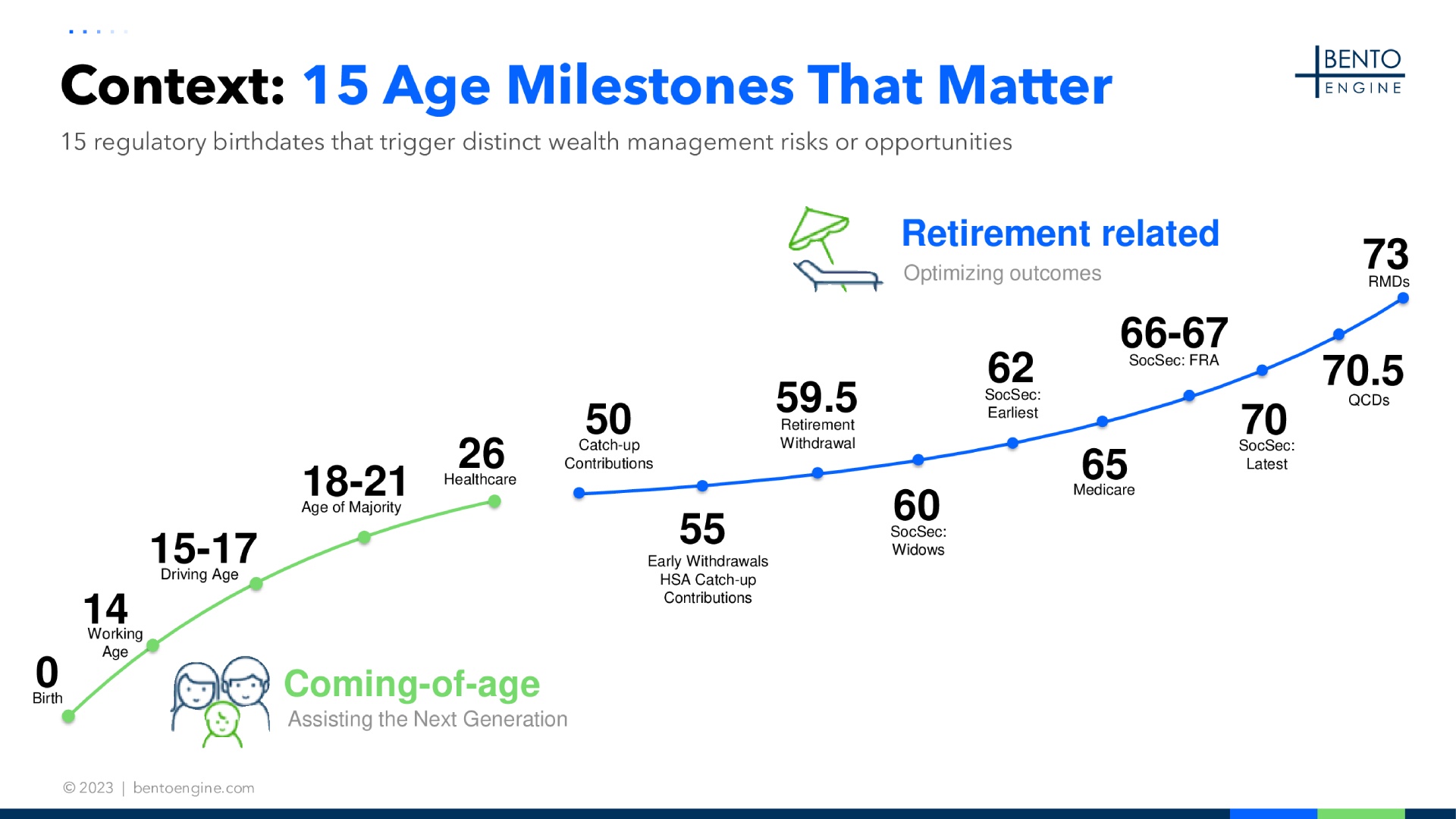

Life In Numbers

Focuses on 15 distinct age-based milestones that trigger distinct wealth management risks or opportunities (think e.g., turning 70.5 and being able to utilize QCDs, or the kids turning 14 and being able to open Custodial IRAs with their first earned income)

Life Events

Which – you guessed it – focuses on dozens of life events that provide golden opportunities to lead with advice and capture money in motion (think e.g., Getting Married, Having a Child, Buying a Home or Moving to a New State)

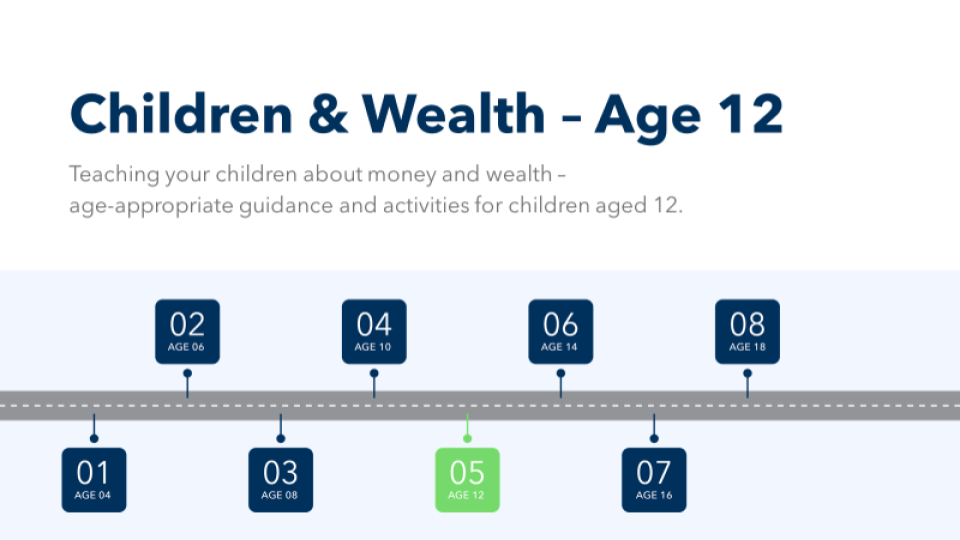

Children & Wealth

Which allows financial advisors to connect with and support the Next Gen of the client family on their financial literacy journey

Bento provides multiple content programs, including:

- Life in Numbers, which focuses on 15 distinct age-based milestones that trigger distinct wealth management risks or opportunities (think e.g., turning 70.5 and being able to utilize QCDs, or the kids turning 14 and being able to open Custodial IRAs with their first earned income)

- Life Events, which – you guessed it – focuses on dozens of life events that provide golden opportunities to lead with advice and capture money in motion (think e.g., Getting Married, Having a Child, Buying a Home or Moving to a New State)

- Children & Wealth, which allows financial advisors to connect with and support the Next Gen of the client family on their financial literacy journey

Recent Awards

Where can FMG users find the Bento Collection?

FMG users can find the Bento Collection right on the Homepage of their FMG system after logging in. Simply scroll down and scan the “Collections” section.

What is included in the Bento Collection?

The Bento Collection contains two format types (emails and downloadables) on a sub-set of our materials, including:

3 Age-Based Milestones:

- 18 — Age of Majority: A watershed moment, where you want to make sure to advise e.g., on Healthcare and Financial POAs

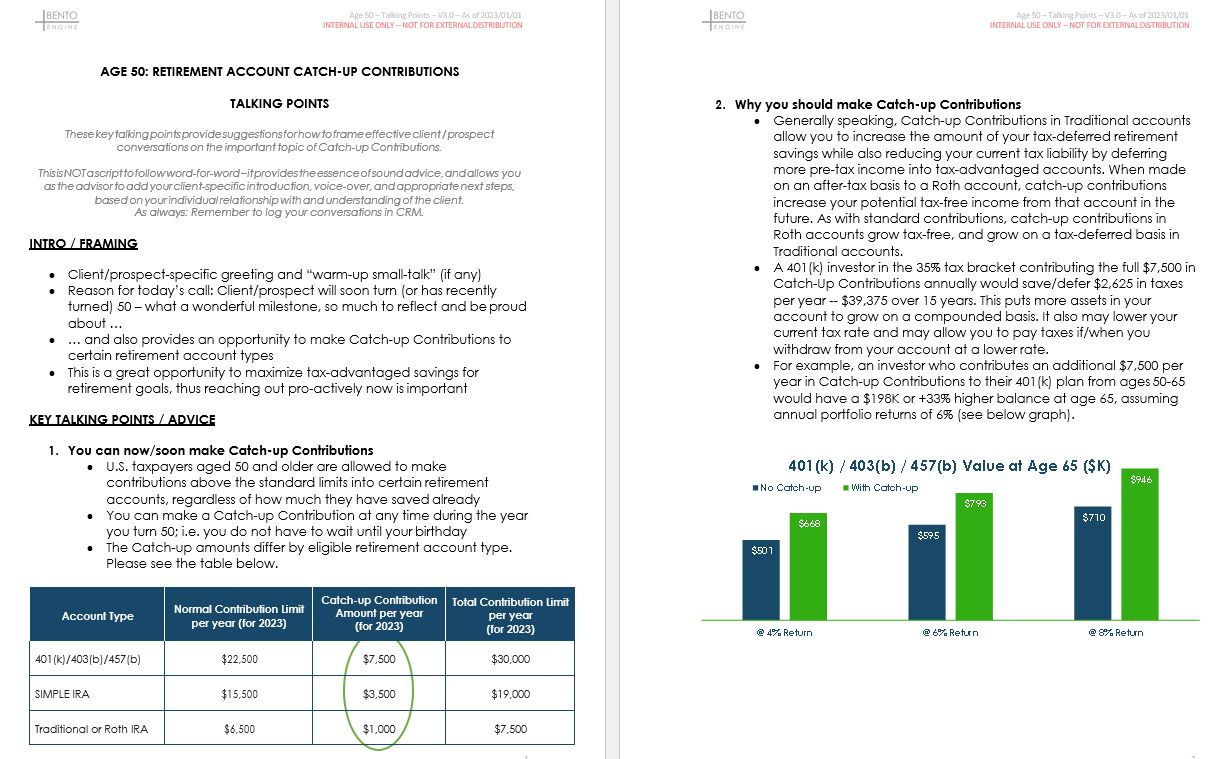

- 50 — Catch-up Contributions: As appropriate, make sure your clients avail themselves of this opportunity to increase their tax-advantaged savings and investing rate

- 62 — Earliest Social Security: The earliest, albeit not always best, age to start collecting hard-earned Social Security benefits

3 Key Life Events:

- Getting Married: So exciting … and so many bases to cover, including financial planning, (joint) banking and investing accounts, estate planning, insurance, taxes, and more

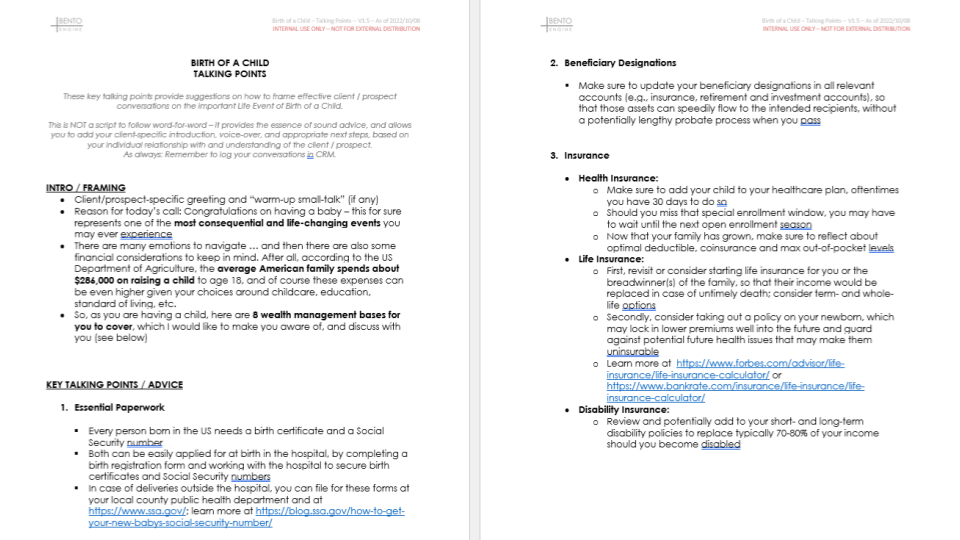

- Birth of a Child: Yes, education funding is a big one, but also consider insurance, beneficiary designations, estate planning and more

- Moving to a New State: Let’s make sure both your former and new state agree with your intended tax domicile

How can advisors best use the materials in the Bento Collection?

- Think about running campaigns across all your clients and prospects! For example, advise everyone in your book how will turn or recently turned 50 on making Catch-up Contributions in their retirement accounts.

- To learn more about the full Bento solution, including the CRM tech-integrations and our complete content library, schedule a meeting below.

How does the full Bento Engine Solution work?

The full Bento solution contains many more format types (e.g., Talking Points, IUO Advisor FAQs) on many more “Moments That Matter”. It also includes a tech integration into your CRM, where our Advice Engine constantly scans your entire book of business to identify upcoming advice opportunities. When we find one, we alert you via a Task/Activity in your CRM, and equip you with all the materials you need to shine right in your CRM.

To learn more, watch this short video:

What CRMs does Bento integrate with?

Testimonials

Ready to learn more?

1. Life in #s

Context

There are 15 age milestones, 15 regulatory birthdates that trigger distinct wealth management risks or opportunities

- 10 relate to retirement

- 5 relate to the Next Gen of the client family

Although they are highly predictable and consequential advice opportunities, not all clients and prospects are getting proactive, impactful advice on these Moments That Matter

Solution

Bento connects via APIs into your CRM, where our algorithms constantly scan your entire book of business to identify upcoming advice opportunities.

When we find one, we alert you via a Task/Activity in your CRM.

That Task/Activity not only indicates a ‘Next Best Action’ (or better ‘Next Best Conversation’ as Kitces puts it), but it also gives you links to compliance pre-approved, impactful materials for you to leverage. We also include a set of Internal Use Only Advisor FAQs, so that you can brush up on the topic as needed.

The advice comes in multiple formats, so that you can pick the best communication mode on a client- or prospect-specific basis.

So you can engage all of your clients and prospects on the right topics, at the right time, in the right way

End Benefits

Everyone wins when you Lead with Advice

For Clients

A better client experience and better client outcomes.

For advisors

More satisfied clients with higher loyalty, higher referral rate and higher share of wallet. Improved prosect conversion due to differentiated advice.

Sample Materials

Age 50 – Catch-up Contributions (to note, only 10-15% of eligible investors currently avail themselves of this tax-advantaged investing opportunity)

2. Life Events

Context

There are dozens of Life Events that not always, but often happen in the lives of your clients and prospects

- Ranging from Birth to Loss of a Loved One

Dozens of high-impact opportunities to Lead with Advice

Solution

As soon as you get wind of a Life Event happening for one of your clients or prospects, you go into your CRM and flag the respective contact.

Bento then sends an advice package with relevant multi-format materials for you to leverage in the form of a Task/Activity.

As always, the advice comes in multiple formats, so that you can pick the best communication mode on a client- or prospect-specific basis. We also include a set of Internal Use Only Advisor FAQs, so that you can brush on the topic as needed.

So you can engage all of your clients and prospects on the right topics, at the right time, in the right way.

Sample Materials

Moving to a New State (to note, every year ~3mm Americans move across state lines)

End Benefits

Everyone wins when you Lead with Advice

Client

A better client experience and better client outcomes.

Advisor

More satisfied clients with higher loyalty, higher referral rate and higher share of wallet. Improved prospect conversion due to differentiated advice.

3. Children & Wealth

Context

Many parents know that Financial Literacy matters, they want to introduce their offspring to the important concepts of money and wealth, but don’t always know when and how.

A big client need / major advice opportunity

Solution

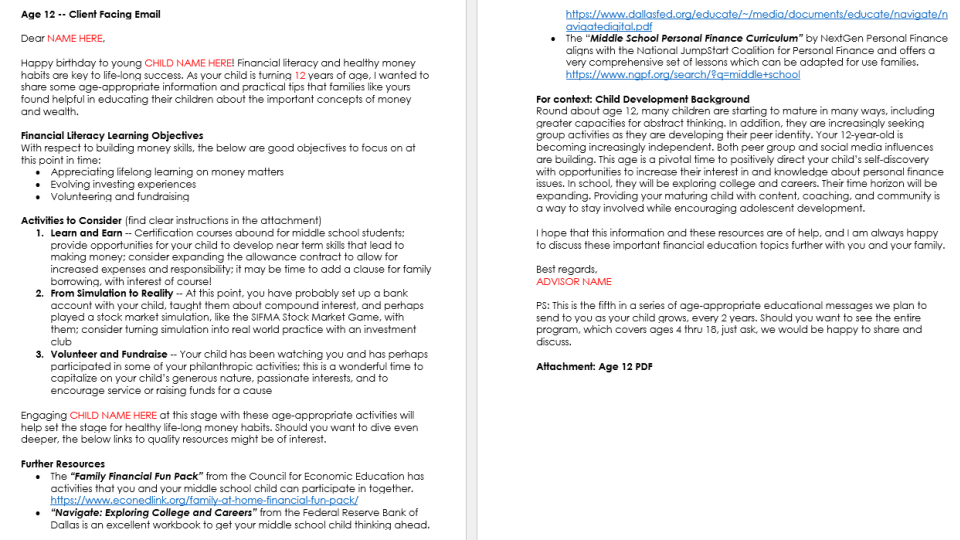

Every two years, as the children turn 4, 6, 8, … years of age, you will receive a Bento Alert in your CRM. The Alert includes links to compliance pre-approved, age-appropriate information, guidance and exercises that you can share with your client or prospect family. This program was developed in partnership with leading educators such as Susan Doty (Director of the Center for Economic Education and Financial Literacy at the University of Texas at Tyler).

When you help your families with educating the Next Generation, everyone wins.

Sample Materials

PPT/PDF

For the family to sue

- Age-appropriate tools and activities to engage in meaningful conversations

- Quality further reading and resources

- For each age 4 thru 18, every two years

- Every two years, as the children of your clients grow from age 4 thru 18 you can share age-appropriate guidance and information with your client / prospect families

- The email introduces key activities to consider, which are then fleshed out in the corresponding PPT/PDF attachment

End Benefits

Client

More engaged, educated and empowered children.

Advisor

Tremendous goodwill and trust from parents, plus an opportunity to connect with the Next Gen in early and constructive ways.

4. Life in #s - Direct to Client Version

Context

In case you have large prospect books or cover large pools of Retirement Plan Participants, you may want to send them age-based advice in an automated way.

Highly efficient, scalable advice for large pools of recipients.

Solution

Bento can connect with your email or Marketing systems (Hubspot, Constant Contact, MailChimp etc.) and automatically send timely and impactful emails on your behalf. You then get to serve qualified inbound leads.

Fully automated, zero effort on your part; find your “diamonds in the rough”

End Benefits

Everyone wins when you Lead with Advice

Prospecting Use Case

Drive prospect conversion by leading with personalized, differentiated advice.

Retirement Plan Participants Use Case

Driving engagement and unearthing real wealth management needs/opportunities. Offering this value-added service will also appeal to plan sponsors, thus you win more business.

5. Your Journey

Context

You have a website. You have traffic on that website. You have a Contact Me form … and yet, if you are like most other advisors, you only convert a very small percentage of website visitors into booked meetings.

Solution

Bento can help. Let’s install our “Your Journey” Lead Gen tool on your website, in your look and feel. The tool will invite visitors to enter their year of birth to learn about key “Moments That Matter” on their wealth management journeys.

Then the tool will sensitize them to the advantages of working with a human advisor, and encourage them to book a meeting with you.

Check out the tool below, and contact us to learn more!

Sample Content

Sample Materials

Age 50 – Catch-up Contributions (to note, only 10-15% of eligible investors currently avail themselves of this tax-advantaged investing opportunity)

Sample Materials

Moving to a New State (to note, every year ~3mm Americans move across state lines)

Compliance pre-approved, multi-format materials for you to leverage.

- Every two years, as the children of your clients grow from age 4 thru 18 you can share age-appropriate guidance and information with your client / prospect families

- The email introduces key activities to consider, which are then fleshed out in the corresponding PPT/PDF attachment

PPT / PDF

For the family to sue

- Age-appropriate tools and activities to engage in

- Quality further reading and resources

- For each age 4 thru 18, every two years

Inventore Veritatis Et Quasi Architecto Beatae Vitae?

Consequ Untur Magni Dolores Eos Voluptatem Sequin?

Inventore Veritatis Et Quasi Architecto Beatae Vitae?

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit.

Consequ Untur Magni Dolores Eos Voluptatem Sequin?

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit.